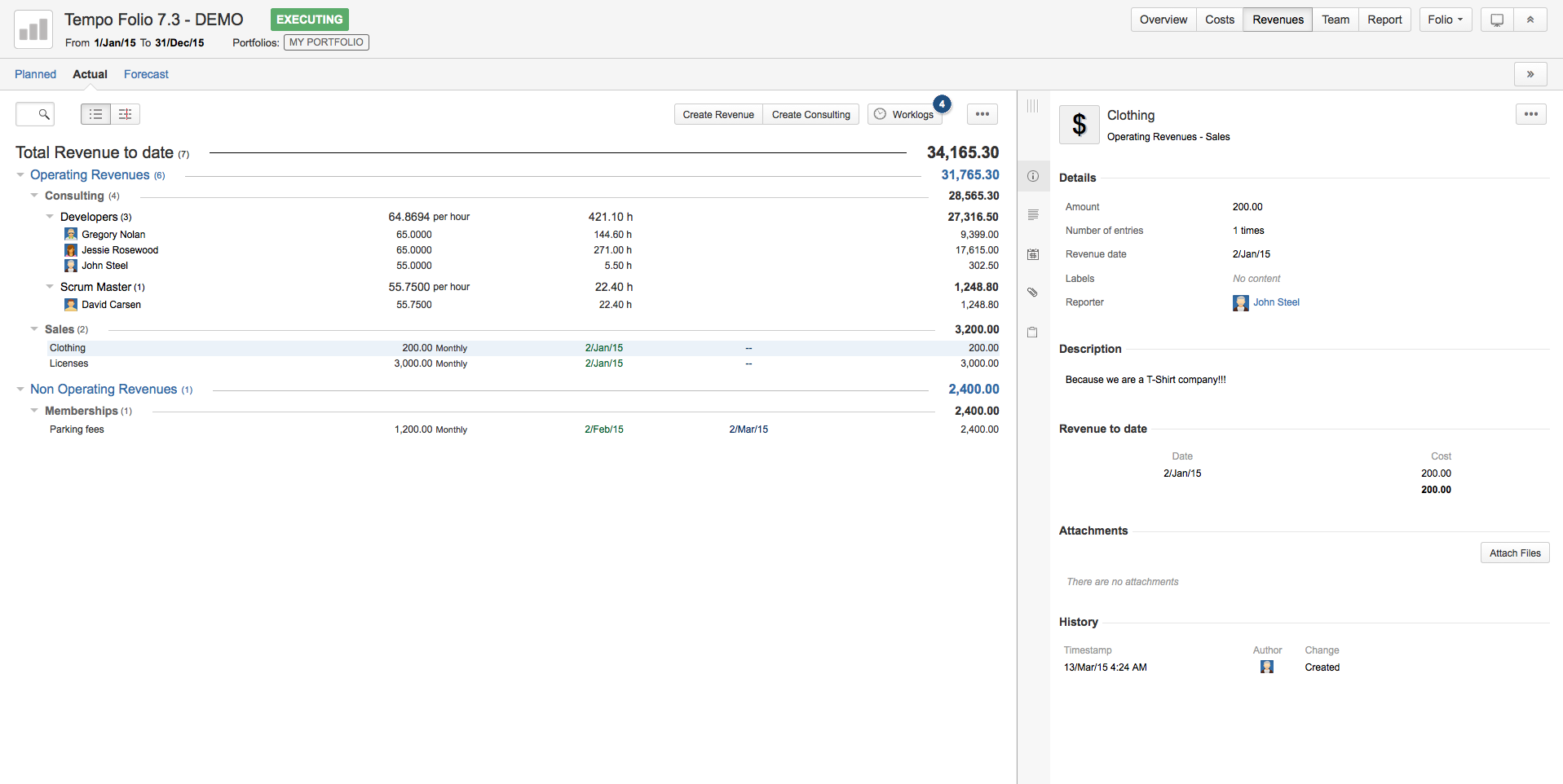

Non-consulting revenues are all revenues that a project can generate other than the revenues generated by billed worked hours. They can include sales, interests received on investments, etc. They are categorized into two broad Categories: Operating and Non-operating. Non-consulting revenues can be single-occurrence or recurrent. Recurrent revenues can also be amortized, in which case the amount associated with received payments will be evenly split over the payment period.

Categories

Categories

Tempo Budgets uses a classic categorization of revenues to better structure your income. Every revenue belongs to one of two main categories: Operating and Non-Operating. You should define revenues in their appropriate category so that you can later get relevant information about the categories themselves, like the total operating revenues.

Operating

Operating revenues are the day-to-day revenues earned during a project's execution, such as consulting services and inventory sales.

Non-Operating

Non-Operating revenues are the portion of an organization's income that is derived from activities not related to its core operations. Non-operating revenues would include such items as dividend income, profits (and losses) from investments, gains (or losses) incurred due to foreign exchange and asset write-downs.

Revenue Recurrence

Non-consulting revenues can be defined to be recurrent using the Recurrence dialog that appears when clicking the Edit link of the Recurring field in the revenue edition dialogs. See Recurrence for more information.

Recurrent revenues can be amortized, in which case their received payments will be evenly spread over their recurrence period. For instance, a monthly amortized revenue of 1,200$ that is defined to recur for 1 year will result in 12 received payments of 100$ each occurring once a month. See the Revenue Calculation section below for more examples on amortized expenses.

Revenues and Folio's Time Frame

Expenditures and revenues can be defined to occur outside of a Folio's time frame. Consequently, you can specify:

-

An expense or revenue occurring before or after the Folio's start and end date.

-

A recurrent expense or revenue to start outside the Folio's time frame with an end date inside the time frame.

-

A recurrent expense or revenue to start inside the Folio's time frame with an end date outside the time frame.

-

A recurrent expense or revenue to start outside of the Folio's time frame with an end date after the end of the Folio.

In any of the above situations, a warning indicator will be displayed next to the expenditure or revenue name and in the detailed panel when the item is selected. Note that only the payment occurrences that happen inside the Folio's time frame are taken into account when calculating costs and revenues at a given date.

Changing the start date or end date

of a Folio can thus affect the number of payments included in calculations. Note also that if the Estimated date of completion of the Folio is later than the planned end date, then the payments occurring after the planned end date will appear in the forecast graph.

Revenue Calculation

The amount of non-consulting revenue is calculated by multiplying its payment amount by the number of payments.

Amoun = Number of payments x Payment amount

The number of payments depends on the recurrence definition for that revenue and the Folio's time frame. Only revenues occurring (inclusively) between the Folio's start and end dates (see Folio Configuration) are taken into account.

Note also that non-working days are not taken into account (e.g., a rent income won't be skipped if the incurrence date is a holiday).

Amount: 100$

|

Recurrence definition |

Monthly on day 1, from 1/Feb/2014 |

|

Folio time frame |

1/Jan/2014 to 1/May/2014 |

|

Number of payments |

4 (February 1st, March 1st, April 1st and May 1st) |

|

Payment amount |

100$ |

|

Cost |

4 x 100$ = 400$ |

|---|

Amount: 100$ (amortized)

|

Recurrence definition |

Monthly on day 1, from 1/Feb/2014 |

|

Folio time frame |

1/Jan/2014 to 1/May/2014 |

|

Number of payments |

4 (February 1st, March 1st, April 1st and May 1st) |

|

Payment amount |

100$ / 4 = 25$ |

|

Cost |

4 x 25$ = 100$ |

|---|

Related pages: